USA Shopping Taxes: Simple Rules Before You Pay

Shopping in the United States can be exciting, but understanding taxes is essential to avoid surprises at checkout. USA shopping taxes may seem confusing at first, but with a few simple rules, you can navigate them like a pro. This guide explains everything you need to know before you pay, helping you plan your purchases wisely.

Understanding USA Shopping Taxes

What Are Sales Taxes?

Sales taxes are charges added to the price of goods and services at the point of purchase. Unlike some countries, the U.S. does not include sales tax in the displayed price. The amount varies depending on the state, county, or city.

Why Sales Tax Matters

Knowing the sales tax rate prevents unexpected costs. Tourists, online shoppers, and residents alike benefit from understanding local tax rules.

State Variations in Sales Tax

Each state sets its own sales tax rate. Some states, like Delaware, Montana, and Oregon, have no sales tax. Others, like California or New York, have rates that can exceed 8%, sometimes combined with local taxes.

Key Rules Before You Pay

Check the State and Local Rates

Before buying, always check the combined state and local sales tax. This ensures you understand the total cost.

Consider Tax-Free Days

Some states offer tax-free holidays on certain items, like school supplies or clothing. Timing your purchase during these periods can save money.

Understand Exemptions

Certain products are exempt from sales tax, including some groceries, prescription medications, and medical devices. Knowing these exemptions helps reduce your expenses.

Online Shopping Taxes

Online purchases are subject to sales tax depending on the seller’s location and your state. Some platforms automatically calculate it, while others require you to self-report.

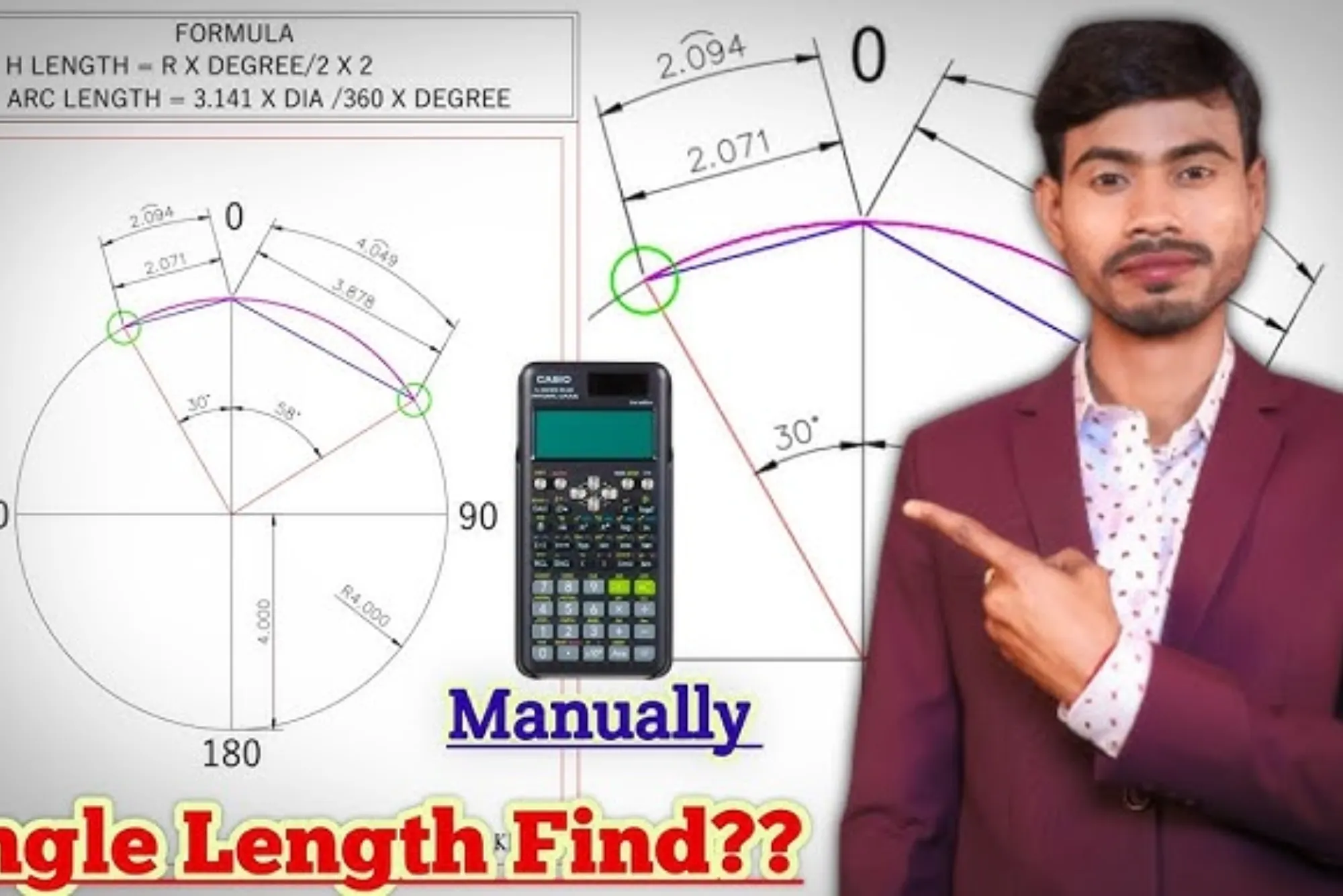

How to Calculate Sales Tax

Step-by-Step Calculation

To calculate sales tax, multiply the item’s price by the applicable tax rate. For example, a $50 item in a state with 7% sales tax costs $53.50.

Use Online Calculators

Many websites provide sales tax calculators. They are especially useful for travelers shopping across different states.

Consider Shipping and Handling

Some states apply sales tax to shipping fees, while others do not. Always check the specific rules before paying.

Tips to Save on USA Shopping Taxes

Shop in Tax-Free States

If you are traveling, consider shopping in states with no sales tax for big-ticket items.

Combine Purchases Strategically

Buying multiple items in a single transaction may qualify for certain discounts or promotions, reducing taxable amounts.

Keep Receipts for Returns

If you return an item, the sales tax is typically refunded. Retaining receipts ensures you can claim your money back.

Use Store Memberships and Promotions

Some memberships and loyalty programs offer tax-free perks or discounts. Always check before you pay.

Understanding USA shopping taxes is simpler than it seems. By knowing state rules, exemptions, and tax-free opportunities, you can save money and shop confidently. Before your next purchase, plan your spending with taxes in mind and enjoy a smooth shopping experience.

Start tracking local sales taxes today and make your shopping smarter and more cost-effective!

FAQ

What items are exempt from sales tax in the U.S.?

Exempt items vary by state but often include groceries, prescription medications, and some medical devices.

How do I know the sales tax rate in a specific state?

Check the state’s official revenue website or use online sales tax calculators for accurate rates.

Are online purchases taxed in the U.S.?

Yes, online purchases may be taxed depending on your state and the seller’s location. Some platforms calculate it automatically.

Can tourists avoid paying sales tax?

Tourists generally cannot avoid sales tax, but shopping in tax-free states or during tax-free holidays can help reduce costs.

Does shipping affect sales tax?

It depends on the state. Some states tax shipping and handling, while others exempt these fees.

Are there tax-free shopping days?

Yes, several states have tax-free holidays for items like school supplies and clothing. Check your state’s schedule.